TL;DR

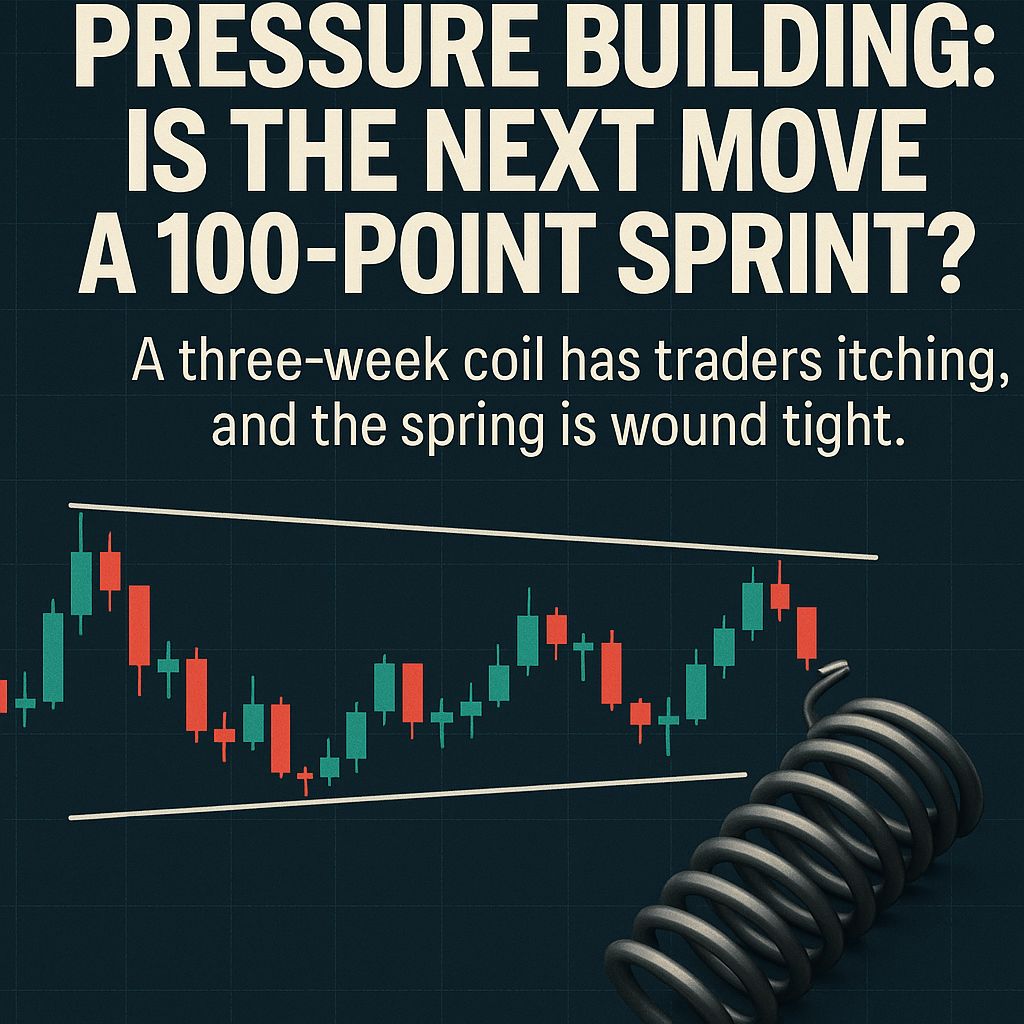

ES keeps ping-ponging between 5979-6099 inside a broader uptrend, so dip-buying remains the default play.

Each flush to 5980 is triggering fresh failed breakdowns that squeeze shorts and snap price back to the 6050 “magnet.”

Volatility from Middle East headlines is adding fuel, but no side has broken the range, meaning energy is still in the tank.

A decisive break of 6099 or 5970 is likely to travel fast, so position sizing and stop discipline matter more than usual.

Stay ahead with insights from our partnered newsletters that can help you navigate the markets. Subscribe here

Sponsored

Market Twists & Turns

Market Twists & Turns: Buy and Sell Opportunities You Can’t Afford to Miss

Quickfire Highlights

Flash PMI miss hints at a cooling services sector

The dollar holds firm, capping crude’s bounce near 80

Tesla sinks after delaying Cybertruck deliveries, opening a possible sympathy short basket in EV names

Small-cap breadth quietly improves, suggesting risk appetite under the hood

Expert investment picks that have returned 200%+

AIR Insiders get picks from expert investors and industry leaders sent straight to their inbox every week. Picks like:

Jason Calacanis recommending Uber at $25/share (200%+ return)

Anthony Scaramucci recommending Bitcoin at $29,863 (200%+ return)

Sim Desai recommending OpenAI at an $86 billion market cap (200%+ return)

Looking to invest in real estate, private credit, pre-IPO ventures or crypto? Just sign up for our 2-week free trial so you can experience all the benefits of being an AIR Insider.

We are firmly in a range-bound regime nested inside a bigger uptrend. Sellers can push price to the lower band, but buyers keep stepping in around 5980. Momentum indicators are flat, and realized vol is compressing after the initial spike on geopolitical news. Translation: we are coiled, not trending.

Failed Breakdown, 5980 pivot: Long on flushes to 5973-5983 with stop under 5965, target 6050 then 6099.

Range Top Reaction: Short scalp at 6099-6105 only if price stalls for 15 minutes, stop 6115, exit 6055 magnet.

Mean Reversion Fade in Tech: QQQ stretches two ATRs above its 5-day MA, opening a quick fade to the 10-day.

Weekly resistance: 6099 first, then 6125 gap high.

Weekly support: 5970, then 5935, a clean volume shelf from early June.

Intra-day magnet: 6050, where cumulative delta flips and VWAP often sits.

Trendline: Rising support from April lows now intersects 5985, adding confluence.

Baseline: Stay flexible. I will buy another failed breakdown under 5980, risking 15 points for a potential 60-point reward.

Aggressive: If futures gap above 6100 on legitimate breadth, I will chase with a tight stop under 6090 aiming for 6125-6150.

Defense: A clean break below 5965 invalidates range logic, so I will stand aside and reassess rather than fight new downside momentum.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before making investment decisions.